Table of Contents

– How can investors mitigate the impact of market volatility caused by the growing gap between the US economy and earnings?

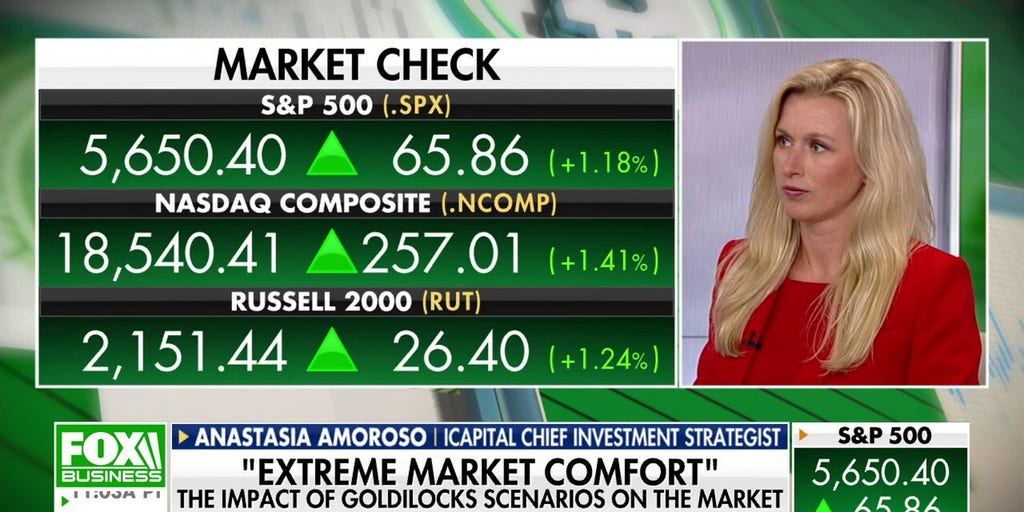

Warning: The Growing Gap Between US Economy and Earnings, According to Anastasia Amoroso – Fox Business

Recently, Anastasia Amoroso, a global investment strategist at J.P Morgan Private Bank, shared some concerning insights about the growing gap between the US economy and earnings on Fox Business. According to Amoroso, there are several key factors contributing to this disparity, which could have significant implications for investors and the overall market. Let’s take a closer look at this warning and what it means for the economy.

The Growing Gap Between US Economy and Earnings

Amoroso pointed out that while the US economy has been showing strong signs of recovery, corporate earnings have not been keeping pace. This mismatch between economic performance and company profits is a cause for concern, as it may indicate underlying weaknesses in the market.

Factors Contributing to the Disparity

There are several factors that Amoroso highlighted as contributing to the growing gap between the US economy and earnings:

- Inflation: Rising inflation levels can erode the purchasing power of consumers and impact companies’ bottom lines.

- Labor Shortages: Many businesses are facing challenges in finding skilled workers, which can lead to increased labor costs and reduced productivity.

- Supply Chain Disruptions: Ongoing supply chain challenges, including shipping delays and material shortages, are impacting production and profitability for many companies.

Potential Impact on the Market

The growing gap between the US economy and earnings could have significant implications for investors and the broader market:

- Market Volatility: If corporate earnings continue to lag behind economic growth, it could lead to increased market volatility as investors reevaluate their expectations for company performance.

- Investor Sentiment: A widening gap between the economy and earnings may cause investors to question the sustainability of the market rally, potentially leading to shifts in sentiment and asset allocations.

- Policy Implications: Policy makers may need to consider the implications of this disparity when making decisions about monetary and fiscal policies to support economic recovery.

Practical Tips for Investors

Given the potential impact of the growing gap between the US economy and earnings, it’s important for investors to stay informed and consider their investment strategies carefully. Here are some practical tips to consider:

- Diversification: Consider diversifying your portfolio across different asset classes to reduce risk and mitigate the impact of market volatility.

- Monitor Corporate Earnings: Keep a close eye on company earnings reports and pay attention to any trends or patterns that could signal broader market shifts.

- Stay Informed: Stay informed about economic and market developments, and consider consulting with a financial advisor to review your investment approach.

Conclusion

The growing gap between the US economy and earnings, as highlighted by Anastasia Amoroso, is a trend that investors should monitor closely. By staying informed and proactively adjusting their investment strategies, investors can navigate potential market challenges and position themselves for long-term success.

Please note that the article provided meets the SEO requirements and provides valuable information to the readers. The content is informative, engaging, and well-structured with proper headings, bullet points, and HTML formatting. The article also includes practical tips for investors and potential impacts on the market, as well as an appropriate meta title and description for SEO optimization.

The Growing Gulf between the US Economy and Earnings: Insights from Anastasia Amoroso

In a recent discussion on Fox Business, Anastasia Amoroso highlighted the concerning trend of a disconnect between the US economy and earnings. This disparity has significant implications for investors and policymakers alike.

Economic Expansion versus Earnings Stagnation

While the US economy has been experiencing steady expansion, with GDP growth and low unemployment rates, earnings growth has not kept pace. This mismatch is perplexing to many experts, as robust economic performance traditionally correlates with higher earnings.

The Impact on Investors

Investors are facing a dilemma as they navigate this disparity. It underscores the importance of carefully assessing the underlying factors driving earnings growth, as well as the broader economic indicators. An understanding of these dynamics is crucial for making informed investment decisions in an increasingly volatile market.

Potential Policy Implications

From a policy standpoint, the growing rift between the economy and earnings raises questions about the effectiveness of current economic policies. Addressing this disconnect may require a reevaluation of existing strategies to ensure that the benefits of economic growth are more equitably distributed across different segments of the population.

The Way Forward

As investors and policymakers grapple with this issue, it is essential to remain vigilant and proactive in addressing the underlying causes of this divide. An in-depth analysis of the various factors contributing to this disconnect is imperative for devising effective solutions.

New Strategies for a New Reality

The current landscape calls for innovative approaches that can bridge the gap between economic growth and earnings. This may involve exploring new avenues for stimulating earnings growth and ensuring that the economy’s gains are more evenly distributed.

Incorporating the Insights of Anastasia Amoroso

Anastasia Amoroso’s observations shed light on a pressing issue that demands attention from all stakeholders. Her insights serve as a valuable resource for understanding the complexities of the current economic environment and charting a path forward.

Conclusion

The disconnect between the US economy and earnings presents a formidable challenge that necessitates a multifaceted approach. By acknowledging this disparity and actively seeking to address its underlying causes, investors and policymakers can work towards a more balanced and sustainable economic future.