How can diversification help mitigate the impact of geopolitical events on 401(k) portfolios?

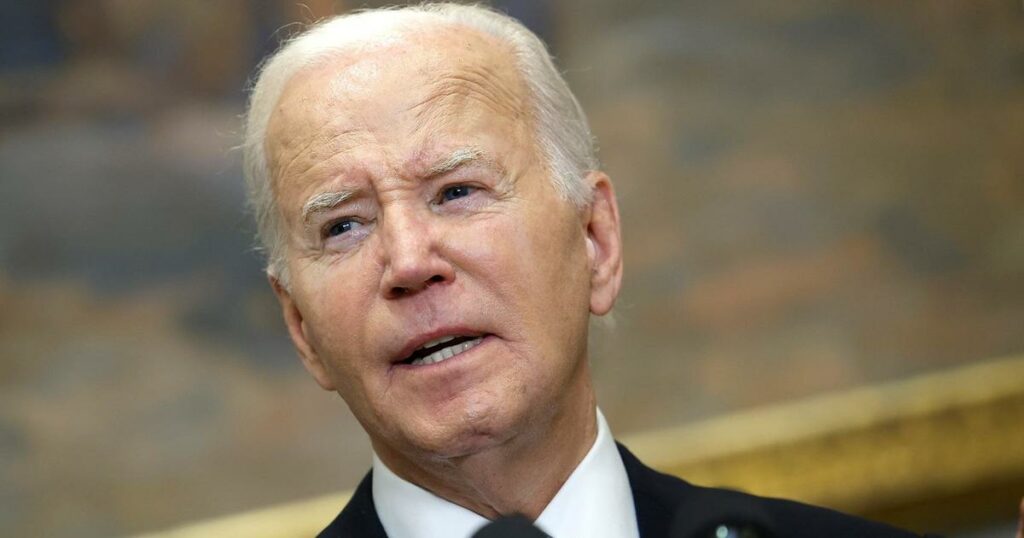

Title: Biden’s Withdrawal: How Investors Are Reacting and What It Means for Your 401(k)

Meta Title: How Biden’s Withdrawal is Impacting Investors and Your 401(k)

Meta Description: Discover the impact of Biden’s withdrawal on investors and how it could affect your 401(k) investments. Learn about the reactions of investors and practical tips to navigate these changes.

The recent withdrawal of U.S. troops from Afghanistan by President Joe Biden has created significant ripples across the world. This decision has not only affected the geopolitical landscape but has also left investors and individuals with 401(k) plans questioning how it might impact their investments. In this article, we’ll explore how investors are reacting to Biden’s withdrawal and discuss the potential implications for your 401(k).

Reactions of Investors

The news of Biden’s withdrawal has caused heightened volatility in financial markets, with stocks experiencing fluctuations in response to the uncertainty surrounding the geopolitical situation. Several key factors have contributed to the reactions of investors, including:

Geopolitical uncertainty: The withdrawal has injected uncertainty into the global geopolitical landscape, leading investors to reevaluate their investment strategies in light of potential ramifications for international trade, security, and diplomacy.

Market volatility: The decision has sparked market volatility, as investors navigate the implications of the withdrawal on sectors such as defense, energy, and infrastructure. This has created fluctuations in stock prices and heightened risk perceptions among investors.

Interest rates: The withdrawal has raised concerns about the potential impact on interest rates and inflation, leading investors to reassess the trajectory of monetary policy and its implications for their investment portfolios.

What It Means for Your 401(k)

Given the potential impact of Biden’s withdrawal on financial markets, it’s natural for individuals with 401(k) plans to wonder how this decision might affect their retirement savings. While the full extent of the implications remains to be seen, there are several considerations to keep in mind:

Diversification: Diversifying your 401(k) portfolio across different asset classes can help mitigate the impact of geopolitical events on your investments. Consider allocating a portion of your portfolio to international equities, bonds, or commodities to spread risk.

Long-term perspective: It’s important to maintain a long-term perspective when assessing the impact of geopolitical events on your 401(k). History has shown that markets tend to recover from short-term volatility, and a well-diversified portfolio can withstand fluctuations over time.

Risk assessment: Conduct a thorough review of your risk tolerance and investment objectives in light of the current geopolitical climate. Consider consulting with a financial advisor to reassess your asset allocation and make any necessary adjustments to align with your risk profile.

Practical Tips

In light of Biden’s withdrawal and its potential impact on your 401(k), here are some practical tips to navigate these changes:

Stay informed: Stay updated on geopolitical developments and their potential implications for financial markets. Understanding the broader context can help you make informed decisions regarding your 401(k) investments.

Review your portfolio: Take the time to review your 401(k) portfolio and assess whether it aligns with your long-term investment goals and risk tolerance. Consider rebalancing your portfolio if necessary to ensure it remains aligned with your objectives.

Seek professional guidance: If you’re uncertain about how Biden’s withdrawal may affect your 401(k) investments, consider seeking guidance from a qualified financial advisor. They can provide personalized insights and recommendations tailored to your specific financial situation.

By staying informed, maintaining a long-term perspective, and being proactive in managing your 401(k) investments, you can navigate the potential impact of Biden’s withdrawal on financial markets with confidence.

Biden’s withdrawal has triggered reactions from investors and raised questions about its implications for 401(k) investments. While uncertainty remains a key factor, being mindful of diversification, maintaining a long-term perspective, conducting risk assessments, and seeking professional guidance can help individuals navigate these changes effectively.

Table:

Here’s a simple table to illustrate the potential impact of Biden’s withdrawal on different asset classes within a 401(k) portfolio:

| Asset Class | Potential Impact |

|---|---|

| U.S. Stocks | Increased volatility, particularly in defense, energy, and infrastructure sectors |

| International Stocks | Potential for geopolitical risk and market volatility |

| Bonds | Impact on interest rates and inflation expectations |

| Commodities | Fluctuations in prices, particularly for energy and precious metals |

By considering these potential impacts across different asset classes, investors can make informed decisions regarding their 401(k) allocations.

As investors continue to monitor developments following Biden’s withdrawal, it’s essential to stay informed, remain proactive in managing your 401(k) investments, and seek professional guidance to navigate the evolving financial landscape effectively.

With President Biden choosing to exit the presidential race and endorse Vice President Kamala Harris as the Democratic party’s candidate, investors and economists are reevaluating the impact of the campaign on various aspects, such as the stock market and the “Trump trade.”

As of now, U.S. markets are reacting calmly to Biden’s decision to step down, with both the S&P 500 index and the Nasdaq rising during Monday trading. However, investors are warning of potential volatility in U.S. markets in the near future, especially if the race tightens with a new Democratic nominee.

Before Biden’s announcement, former President Trump had surged ahead in the polls, leading to his biggest national margin over Biden up to that point. This momentum had sparked the “Trump trade,” which entails investing in assets and stocks perceived to thrive under a Republican presidency, such as cryptocurrencies and energy stocks.

Now, Wall Street is assessing the new landscape and scrutinizing the economic policies and viewpoints of Harris, who has garnered support from leading Democrats to take Biden’s place. A potential new Democratic presidential nominee might result in a tighter race, potentially causing more volatility across U.S. markets. Anatole Kaletsky, co-founder and chief economist of investment advisory firm Gavekal, predicts heightened uncertainty resulting from the unexpected turn in U.S. politics.

The stock market may see downward pressure due to the newfound unpredictability in the presidential race, cautioning investors of increased market volatility. However, on Monday morning, Wall Street showed that investors primarily rely on economic data and corporate earnings to make investment decisions, rather than political events.

On the Trump trade front, some institutional investors are still favoring Trump, despite the shift in odds following Harris becoming the Democratic nominee. As a result of Biden’s decision, the Trump trade appears to be losing its momentum, with assets like cryptocurrencies showing a decline in value.

Recent momentum has favored the Republican Party, but market dynamics could change in light of the latest developments. The focus is now on Harris’ economic views to understand what her candidacy could mean for the economy and U.S. markets. Wall Street anticipates her continued support for initiatives benefiting green energy, efficiency, and electric vehicle makers.

One notable difference between Biden and Harris is their stance on trade policy, with Harris voting against the United States-Mexico-Canada Agreement (USMCA) and the Trans-Pacific Partnership (TPP) due to environmental concerns. This suggests that she might prioritize environmental and climate issues over trade deals.